Can You Claim Mileage And Depreciation On A Vehicle . In general, if clients have a vehicle they use for business. Web expenses you can claim. This rate, set by the irs,. For example, if your transmission broke down. Interest on a motor vehicle loan; Web you can claim a section 179 deduction and use a depreciation method other than straight line only if you don’t use the. Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. Web can you deduct vehicle depreciation on taxes? Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car.

from rennlist.com

This rate, set by the irs,. For example, if your transmission broke down. Interest on a motor vehicle loan; Web can you deduct vehicle depreciation on taxes? In general, if clients have a vehicle they use for business. Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. Web you can claim a section 179 deduction and use a depreciation method other than straight line only if you don’t use the. Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. Web expenses you can claim.

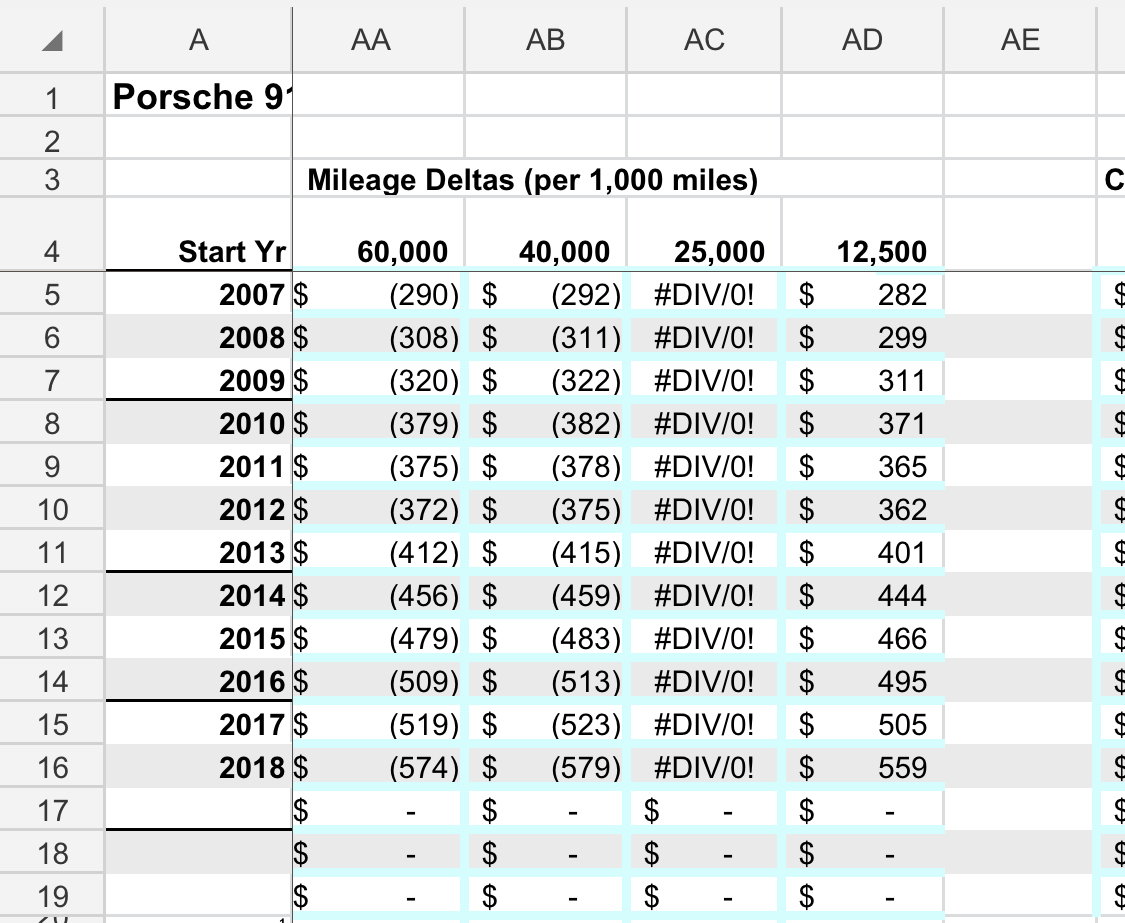

Mileage depreciation?!? Rennlist Porsche Discussion Forums

Can You Claim Mileage And Depreciation On A Vehicle Interest on a motor vehicle loan; Web expenses you can claim. Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. In general, if clients have a vehicle they use for business. Web you can claim a section 179 deduction and use a depreciation method other than straight line only if you don’t use the. Interest on a motor vehicle loan; Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. This rate, set by the irs,. For example, if your transmission broke down. Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. Web can you deduct vehicle depreciation on taxes?

From owlcation.com

Methods of Depreciation Formulas, Problems, and Solutions Owlcation Can You Claim Mileage And Depreciation On A Vehicle Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. Web can you deduct vehicle depreciation on taxes? This rate, set by the irs,. Web you can claim a section 179 deduction and use a depreciation method other than straight line only if you don’t use the. For example, if your transmission broke. Can You Claim Mileage And Depreciation On A Vehicle.

From brookenella.blogspot.com

Irs vehicle depreciation calculator BrookeNella Can You Claim Mileage And Depreciation On A Vehicle Web expenses you can claim. Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. Interest on a motor vehicle loan; Web can you deduct vehicle depreciation on taxes? Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard. Can You Claim Mileage And Depreciation On A Vehicle.

From danieljduvallxo.blob.core.windows.net

What Is The Standard Depreciation For A Car Can You Claim Mileage And Depreciation On A Vehicle Web can you deduct vehicle depreciation on taxes? For example, if your transmission broke down. This rate, set by the irs,. Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. Interest on a motor vehicle loan; Web expenses you can claim. Web when. Can You Claim Mileage And Depreciation On A Vehicle.

From www.sampletemplates.com

FREE 49+ Claim Forms in PDF Can You Claim Mileage And Depreciation On A Vehicle This rate, set by the irs,. Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. In general, if clients have a vehicle they use for business. Web expenses you can claim. Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. Interest on a motor. Can You Claim Mileage And Depreciation On A Vehicle.

From www.sampletemplates.com

FREE 8+ Sample Expense Forms in PDF MS Word Can You Claim Mileage And Depreciation On A Vehicle This rate, set by the irs,. Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. Web expenses you can claim. Web you can claim a section 179 deduction and use a depreciation method other than straight line only if you don’t use the. Interest on a motor vehicle loan; For example, if. Can You Claim Mileage And Depreciation On A Vehicle.

From www.wallstreetprep.com

What is Depreciation? Expense Formula + Calculator Can You Claim Mileage And Depreciation On A Vehicle In general, if clients have a vehicle they use for business. Web expenses you can claim. This rate, set by the irs,. Interest on a motor vehicle loan; Web can you deduct vehicle depreciation on taxes? Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. For example, if your transmission broke down.. Can You Claim Mileage And Depreciation On A Vehicle.

From atotaxrates.info

Depreciation of Vehicles atotaxrates.info Can You Claim Mileage And Depreciation On A Vehicle Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. This rate, set by the irs,. In general, if clients have a vehicle they use for business. Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car.. Can You Claim Mileage And Depreciation On A Vehicle.

From signalduo.com

Top 8 is accumulated depreciation an asset 2022 Can You Claim Mileage And Depreciation On A Vehicle Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. Web you can claim a section 179 deduction and use a depreciation method other than straight line only if you don’t use the. In general, if clients have a vehicle they use for business. This rate, set by the irs,. Web can you. Can You Claim Mileage And Depreciation On A Vehicle.

From studylib.net

Mileage Rate Deemed Depreciation, Adjusted Basis of Vehicle Can You Claim Mileage And Depreciation On A Vehicle This rate, set by the irs,. In general, if clients have a vehicle they use for business. Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. Web can you deduct vehicle depreciation on taxes? Web when you use the standard mileage rate deduction,. Can You Claim Mileage And Depreciation On A Vehicle.

From n-accounting.co.uk

How Do You Claim Mileage on Electric Cars Can You Claim Mileage And Depreciation On A Vehicle Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. Web can you deduct vehicle depreciation on taxes? Web expenses you can claim. This rate, set by the irs,. Web at tax time, you can claim a standard mileage rate deduction for every mile. Can You Claim Mileage And Depreciation On A Vehicle.

From www.youtube.com

Depreciation 101 Vehicle Depreciation YouTube Can You Claim Mileage And Depreciation On A Vehicle Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. In general, if clients have a vehicle they use for business. Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. For example, if your transmission broke. Can You Claim Mileage And Depreciation On A Vehicle.

From drivefoundry.com

Ferrari A Guide To Depreciation Including Examples Can You Claim Mileage And Depreciation On A Vehicle Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. In general, if clients have a vehicle they use for business. Interest on a motor vehicle loan; Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. For example, if your transmission broke down. Web if. Can You Claim Mileage And Depreciation On A Vehicle.

From lotussmart.com.au

How to Claim Tax Deductions for Car Expenses in Your Tax Return Can You Claim Mileage And Depreciation On A Vehicle This rate, set by the irs,. Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. Web expenses you can claim. For example, if your transmission broke down. Web can you deduct vehicle depreciation on taxes? In general, if clients have a vehicle they. Can You Claim Mileage And Depreciation On A Vehicle.

From www.autopadre.com

Ford F150 Depreciation Rate & Curve Can You Claim Mileage And Depreciation On A Vehicle Web expenses you can claim. Web can you deduct vehicle depreciation on taxes? For example, if your transmission broke down. Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. Web you can claim a section 179 deduction and use a depreciation method other. Can You Claim Mileage And Depreciation On A Vehicle.

From www.taxscan.in

Partnership Firm Can Claim Depreciation on Motor Vehicle Even if Can You Claim Mileage And Depreciation On A Vehicle This rate, set by the irs,. Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. For example, if your transmission broke down. Web can you deduct vehicle depreciation on taxes? In general, if clients have a vehicle they use for business. Web when. Can You Claim Mileage And Depreciation On A Vehicle.

From haipernews.com

How To Calculate Notional Depreciation Haiper Can You Claim Mileage And Depreciation On A Vehicle Web at tax time, you can claim a standard mileage rate deduction for every mile you drove. For example, if your transmission broke down. Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. Interest on a motor vehicle loan; Web if you choose the mileage, you won’t be able to claim depreciation. Can You Claim Mileage And Depreciation On A Vehicle.

From www.youtube.com

Analyzing selfemployed Vehicle mileage depreciation overview Can You Claim Mileage And Depreciation On A Vehicle Web when you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. Web you can claim a section 179 deduction and use a depreciation method other than straight line only if you don’t use the. For example, if your transmission broke down. Web expenses you can claim. This rate, set by the irs,. Web at. Can You Claim Mileage And Depreciation On A Vehicle.

From ufreeonline.net

50 Example Mileage Log For Taxes Can You Claim Mileage And Depreciation On A Vehicle This rate, set by the irs,. For example, if your transmission broke down. Interest on a motor vehicle loan; Web if you choose the mileage, you won’t be able to claim depreciation as a standalone deduction — it’s already included in the standard mileage rate. Web can you deduct vehicle depreciation on taxes? Web expenses you can claim. Web at. Can You Claim Mileage And Depreciation On A Vehicle.